If your team is still using cumbersome spreadsheets for investor accounting, you’re flirting with disaster. Flawed macros, transposed numbers, even small mistakes increase your risk. Integra INVESTOR eliminates those vulnerabilities by automating custodial reconciliation in a controlled system environment.

INVESTOR gives you complete control and visibility over investor accounting, reconciliation and reporting. Built for mortgage professionals by mortgage professionals, it’s the only end-to-end solution designed for the complex processes critical to servicing success.

- Custodial reconciliation Loan-level transaction analysis and TOEC visibility for FHLMC, FNMA, GNMA, private label and other agency requirements

- Clearing account reconciliation Specialized tools to automatically manage and reconcile payment, disbursement and miscellaneous clearing accounts with 90%+ matching rates

- Investor accounting Outage management and compliant forms that meet all agency requirements—with automatic updates to ensure compliance when regulations and forms change

- Banking and cashbook Automatic daily bank statement processing, transaction tracking, cash flow management and integrated cashbook tools for informed decision-making

- EFT processing and settlements Effortless electronic funds transfers that ensure smooth, timely transactions while minimizing risks

Full control and visibility, anytime, anywhere

Integra INVESTOR is a fully auditable, peer-reviewed SaaS solution that works in real time, just like you do. Integra INVESTOR gives your team:

- Real-time dashboards that keep your team accountable and on track

- Submission and approval workflows that ensure that incomplete work can’t be submitted

- Automatic updates to ensure compliance with changes to regulations and agency forms

Positioning your organization for growth

A key driver of business success is consistency—in quality, service and results. Integra INVESTOR drives the process standardization you need to thrive:

- Operational uniformity

- Faster training

- Enhanced scalability

Real-world results

A top-20 regional bank left Excel-based custodial reconciliation behind and achieved major performance improvements with Integra INVESTOR.

89% improvement in overall efficiency of custodial reconciliation

60% reduction in QA/QC time for submitted reconciliation—from 50 hours to fewer than 20 hours

64% reduction in training time for new employees—from 110 hours to 40 hours

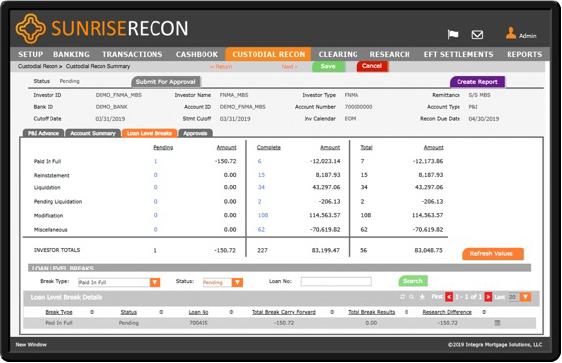

CUSTODIAL RECONCILIATION

Reduce the manually intensive and repetitive tasks of custodial reconciliation. Integra INVESTOR identifies the root cause of outages, so they don’t keep occurring month after month. Once identified, the system automatically tracks and ages each item until it is resolved.

Features and benefits

Complete P&I and T&I reconciliation for FNMA, FHLMC, GNMA and private-label portfolios (all remittance types and other agencies also supported)

Complete P&I and T&I reconciliation for FNMA, FHLMC, GNMA and private-label portfolios (all remittance types and other agencies also supported)- Loan-level test of expected cash calculations and identification of reconciliation differences (outages)

- Automated root-cause identification, tracking, aging and clearing of reconciliation outages

- Real-time dashboards with metrics showing all pending, submitted and approved work items

- Completion of agency reporting requirements (form 496, 59, etc.) with history retention

- Submission and approval workflow over custodial reconciliation processing/quality control

- Expanded library for importing Black Knight MSP and Sagent source data reports, plus other servicing platforms, including TMO, Servicing Director and Jack Henry

- Tracking and balancing of P&I advance balance and transaction activity

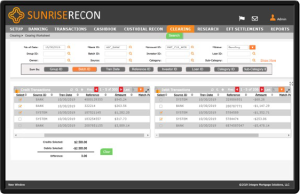

CLEARING ACCOUNT RECONCILIATION

Automatically combine and organize bank statement data with information from multiple departments, from cashiering to treasury, all in one clear summary. Easily handle payment clearing, disbursement clearing, wire/ACH clearing and other miscellaneous clearing. Simple-to-assign attributes let you wrangle all the sources for payment clearing reconciliation and bring meaning to batches and other data.

Features and benefits

Specific tools for reconciling payment, disbursement and miscellaneous clearing accounts

Specific tools for reconciling payment, disbursement and miscellaneous clearing accounts- Customizable reconciliation rules based on transaction sourcing, bank statement addenda, etc.

- Flexible Excel-driven import formats for consuming virtually any source data layout

- Tracking and ageing of reconciling items (bank errors, discrepancies, duplicate items, etc.)

- Complete visibility over outstanding vs. paid disbursements and cleared items (current and historical)

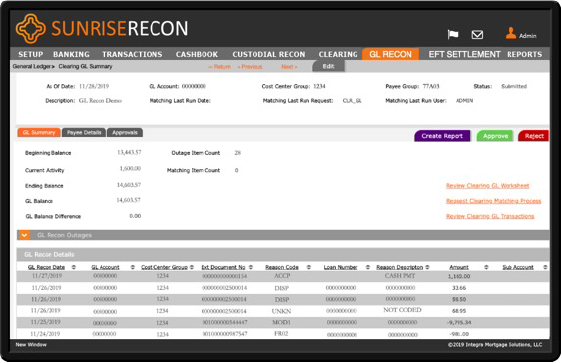

INVESTOR ACCOUNTING

Reconcile and certify general ledger activity and clear exceptions in a workflow-enabled application that seamlessly integrates with various GL sources and core banking systems. Leverage loan-level data and reporting from your servicing platform to bring rich information into your general ledger reconciliation.

Features and benefits

Reconcile and certify GL balance and transaction activity from multiple sources with simple mapping.

Reconcile and certify GL balance and transaction activity from multiple sources with simple mapping.- Track, age and resolve GL exceptions with built-in workflows and automated matching rules.

- Link loan-level payee data from your servicing system to get a full picture of the transaction.

- Clear more exceptions automatically with configurable reconciliation rules supporting complex match scenarios.

- Certify reconciliations with built-in quality assurance and submission/approval quality controls.

- Retain history of approvals and exceptions handling to address audit requests faster

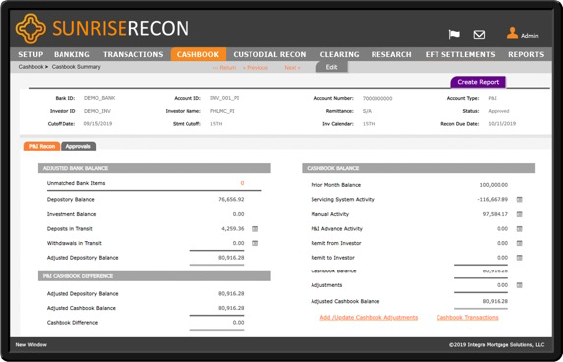

BANKING AND CASHBOOK

Link directly to financial institutions for bank statements and streamline bank account reconciliation. Integra INVESTOR’s banking and cashbook module brings connectivity, efficiency and control over book-to-bank reconciliation and bank statement certifications.

Features and benefits

Automated book-to-bank reconciliation of bank accounts with formal reporting

Automated book-to-bank reconciliation of bank accounts with formal reporting- Daily import of bank balance and transaction information for distribution within the enterprise

- Real-time dashboards with metrics showing all pending, submitted and approved work items

- Submission and approval workflows over cashbook processes and quality control

- Certification of transaction-level activity in bank statements via automated matching of book items

- Daily depository account balancing between the bank and your servicing system

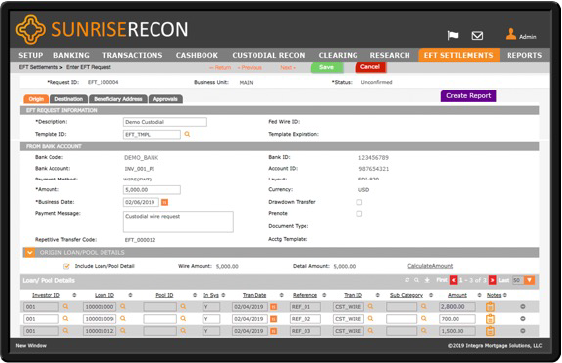

EFT PROCESSING AND SETTLEMENTS

Process wire and ACH payments directly with your bank or interface with your treasury workstation while retaining loan-level details of manual payments and remittances. Remove the information gap between department-initiated EFT requests, approvals and settlement details.

Features and benefits

SOX-compliant ACH/wire submission and approval process with formal reporting

SOX-compliant ACH/wire submission and approval process with formal reporting- Direct settlement with banks, plus support for payment acknowledgements and confirmations

- Retained detail of loan-level transaction activity for clearing custodial reconciliation outages

- Powerful EFT-approval routings and workflows based on user roles and dollar-amount allowances